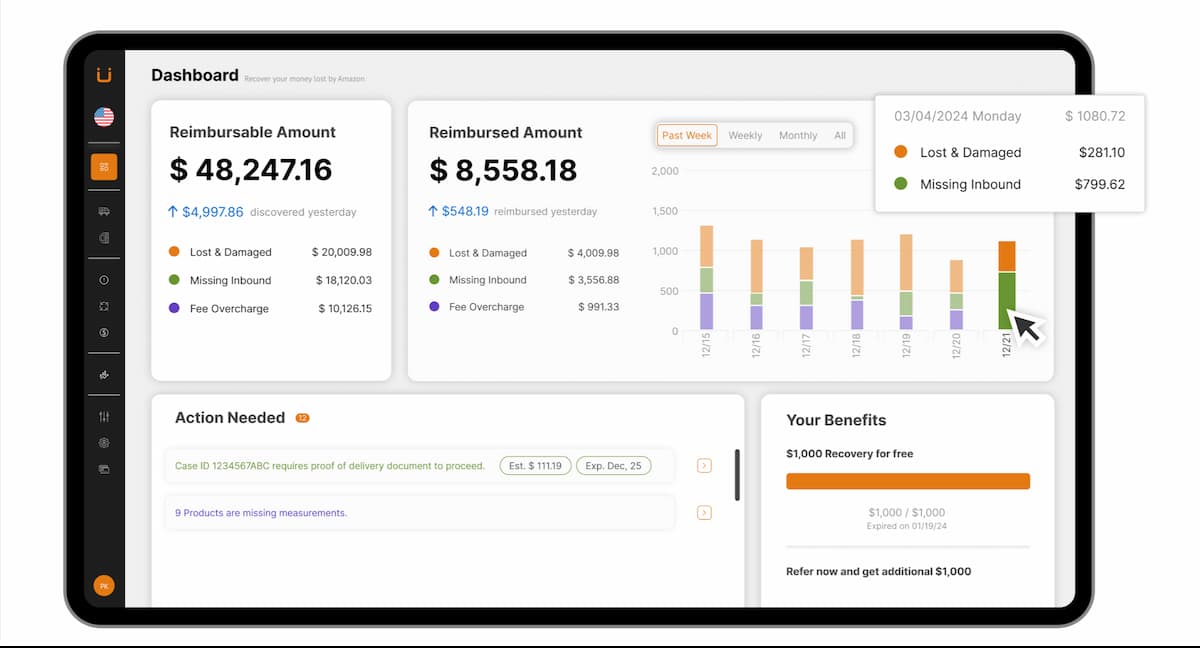

How Reimbursement Tools Transform FBA Accounting

Amazon FBA (Fulfillment by Amazon) is a game-changer for many sellers. It allows businesses to leverage Amazon’s massive logistics network, letting them focus more on sales and less on shipping. However, managing FBA accounting can be challenging. There are numerous aspects to track, from fees to inventory adjustments. This is where reimbursement tools come into … Read more